Cost-Effective Access to Each Order at Every Price Level.

Overview: DIH has partnered with BMLL Technologies to provide level 3 depth of book data, analytics, and visualization tools. We source, harmonize and maintain all of the data in the cloud.

Use our python libraries, analytics packages, execution simulators, and machine learning libraries to analyze our data and run multiple computations in parallel across all our markets. Quickly get the resources you need using our APIs and dashboards.

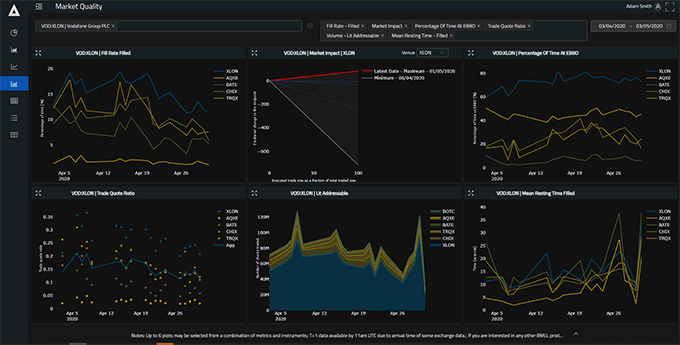

You can receive data feeds of over 280 predefined or bespoke analytics delivered via bulk file download or API. We offer browser-based visualization tools, too.

Coverage: Our level 3 depth of book data solution includes each individual order from over 65 exchanges and trading venues around the world. We cover equities, ETFs, and futures.

History: We have level 3 depth of book data going as far back as 2013.

Updates: We update our level 3 depth of book data’s prices and reference data on a daily basis.

Delivery: We offer several ways to interact with our level 3 depth of book data:

DATA LAB – This data as a service (DaaS) solution gives you full access to our data lake and research tools in a secure, scalable cloud environment.

DATA FEED – Receive 280+ predefined or bespoke metrics based upon our level 3 data via bulk file download, S3 to S3, or API.

DATA VIZ – Visualize our data and metrics from your browser.

License Terms: We license our level 3 depth of book data for either your internal use only or to display to your clients (additional restrictions apply – contact us for details).

Pricing: Several inputs go into the pricing for our level 3 depth of book data. For example, do you want level 3 depth of book data for all available countries/markets and securities, or a subset? How much history do you want? Do you want updates going forward? Contact us to learn more.

We Handle The Data & IT, So You Can Focus On Your Research.

Now you can focus on your research and let us handle sourcing, normalizing, and managing all the data and IT in AWS.

Our 15-petabyte data lake sits at the core of our offering. We process over 200GB of raw exchange data daily and harmonize it into a single consistent information-rich format offered at every level of granularity. All our data is level 3, meaning we have every order sent to the market. This granularity combined with our analytics enables end-users to truly understand the inner workings of the market.

Institutional market participants gain deeper insights into market behavior and make more informed decisions using our level 3 depth of book data. Our clients include:

- Investment banks

- Brokers

- Hedge funds (systematic & non-systematic)

- Asset managers

- Proprietary trading firms

- Exchanges and trading venues

- Service providers (e.g. OMS, EMS, data vendors, etc.)

Our level 3 depth of book data seamlessly integrates with your production tools and workflows, allowing you to efficiently turn research into actionable results. Power up the cloud resources you need, and in a few lines of code, you can unlock the predictive power of order book data.

What Exactly is Level 3 Depth of Book Data?

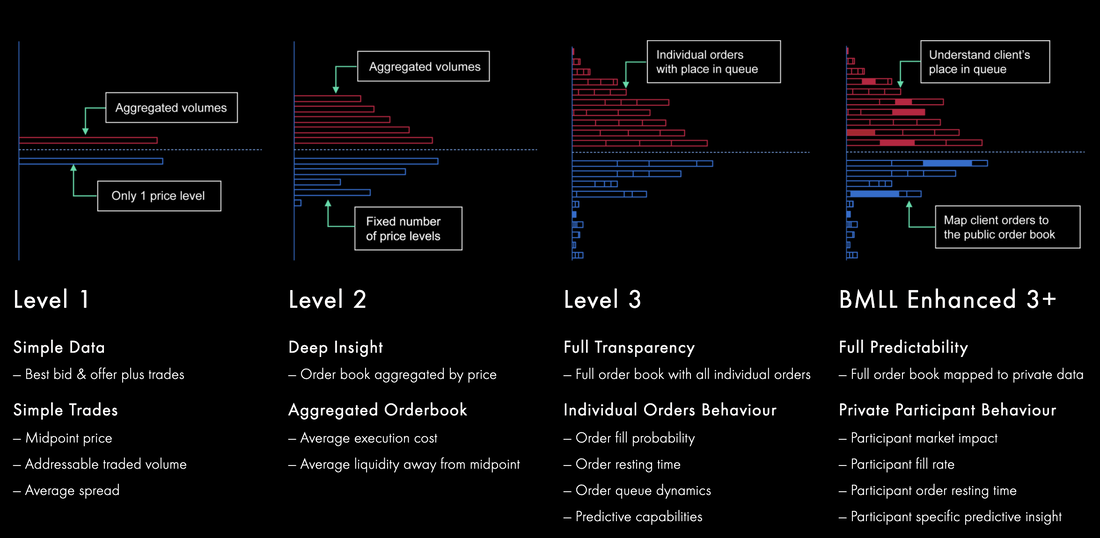

In any order book there are three (3) levels:

Level 1 – The simplest level of the order book and includes the best bid and offer along with trades. From level 1 of the order book you can determine such insights as the midpoint price, addressable traded volume, and average spread.

Level 2 – The next level of granularity of the order book is called level 2, which aggregates all of the orders and sizes at each price level (often limited to five to ten price levels). Level 2 data can be used to calculate average execution costs and liquidity away from the midpoint.

Level 3 – The finest level of granularity is level 3 and provides full transparency of the order book. You see each individual order at each price level. This enables you to see the behavior of each order and determine such useful insights as order fill probability, resting time, queue dynamics, and other predictive capabilities.

DIH and BMLL can take level 3 depth of book data even further by mapping it to your private order flow data. This way we can determine a market participant’s market impact, fill rate, order resting time, and specific predictive insights.

Who Can Benefit from Level 3 Depth of Book Data?

There is a wide variety of capital markets participants currently using our level 3 depth of book solutions for a myriad of use cases:

Investment Banks & Brokers utilize our data and analytics for:

- Research across the firm

- Algo optimization

- Trading analytics

- Data-driven sales insights

- Risk management

Exchanges & Trading Venues find themselves in an increasingly competitive, multi-venue market. Our data and analytics can help them stand out by enhancing their workflows with granular data and machine learning capabilities to critically analyze the venue and make informed policy decisions. With our data, venues can:

- Drive greater yield via optimized pricing & fee structures for providers & takers of liquidity

- Develop new products to optimize trading volume

- Monitor market share developments across metrics their clients care about

- Enhance their current data products to deliver greater value to their clients

Systematic Hedge Funds count on our level 3 depth of book solutions to improve the ROI of their data and analytics. Quant teams are able to deliver predictive alphas, faster and at a lower price point than before. By enhancing workflows with our suite of predictive analytics and scalable research, they can unlock patterns in market behavior, enhance signal generation & optimize algorithm performance at a fraction of the cost of building the capabilities in-house.

Non-Systematic Hedge Funds and Asset Managers also benefit from our level 3 depth of book solutions. Their portfolio managers (PMs) and researchers can become more effective and deliver predictive alphas, faster and at a lower price point than before. PMs and researchers can make more informed decisions at the position and portfolio level using existing workflows enhanced with greater data and analytics capabilities. For example, they can quickly:

- Generate portfolio composition insights, improve executions, and more cost-effectively evaluate new market entries

- Better understand market conditions surrounding trades across venues

- Have more context to understand decisions brokers make when routing trades

Service Providers (e.g. OMS, EMS, data vendors, etc.) rely upon our granular level 3 depth of book data and machine learning capabilities to be integrated directly into their clients’ workflows. The resulting data and analytics deliver greater value to their clients by enhancing their front-, middle- and back-office functions. For example, they can use our data to generate:

- Provide their clients and competitive venues with more detailed trading insight based on number of orders, true liquidity positioning and cost to liquidate a given size

- Change market participant behavior by optimizing compensation structures by analyzing granular order dynamics

Level 3 Depth of Book Data is Hard, Even for the Largest Firms.

Up to now, very few market participants have had access to level 3 depth of book data. With the exception of very large systematic hedge funds and high-frequency trading (HFT) groups, most institutions lack such data because:

- Exchanges & trading venues don’t make the data readily available

- Storing & harmonizing such granular data is difficult

- Managing cloud IT is difficult & costly

- Analyzing such data requires special tools

Before subscribing to our solution, one of the largest and most technically capable global investment banks tried to build a similar solution in-house. After months of effort and tens of millions of dollars, they were no closer to having a comparable solution. They cited many of the challenges above as major pain points. So eventually they abandoned trying to build their own level 3 depth of book data solution and subscribed.

It was a similar story for one of the largest exchanges in the world. Despite a formidable data products group within the firm, they also found it more cost-effective to license our level 3 depth of book data solution. They were able to go to market in a matter of weeks without the hassle and expense of all that data engineering and data wrangling.

So if the largest global firms cannot cost-effectively build and manage such a solution in-house, what chance do the majority of market participants have?

Most firms don’t have the budget, expertise, and/or time to build and maintain such a solution. Even if a firm creates an in-house solution, it is probably purpose-built and not flexible enough to accommodate the various use cases thrown at it. Also, the ongoing maintenance of such an infrastructure is costly.

Flexible Updates & Delivery.

We offer several ways to interact with our level 3 depth of book data:

DATA LAB – This data as a service (DaaS) solution gives you full access to our data lake and research tools in a secure, scalable cloud environment.

DATA FEED – Receive 280+ predefined or bespoke metrics based upon our level 3 data via bulk file download or API.

DATA VIZ – Visualize our data and metrics from your browser.

All of our raw underlying price and reference data are updated each day to ensure you can compare orders across venues.

We offer flexible scheduling of the delivery of our 280+ pre-defined metrics or your bespoke metrics.

We deliver data in various file formats (e.g. CSV) via download, S3 to S3 transfer, or API.

We make it easy (and affordable) to analyze level 3 depth of book data in the cloud.

We make it easy (and affordable) to analyze level 3 depth of book data in the cloud.